Welcome to our Monthly Lumber Commodity Report.

This resource is dedicated to providing builders, contractors, and homeowners with the latest insights into lumber market fluctuations, aimed at empowering you to make informed decisions for pricing and budgeting future projects enabling better preparation and planning for your construction and home improvement endeavors.

To ensure you’re always updated, bookmark this page and consider subscribing for direct updates by emailing dannys@lumbertradersinc.com with “Please add to commodity report” in the subject line.

As a subscriber, you’ll receive these critical reports straight to your inbox, providing you with the knowledge needed to navigate the complexities of lumber pricing effectively. Stay informed with us, and together, let’s build a future that’s not just promising but well-prepared.

See below for latest graphs and commentary.

As you do your quotes, just a reminder to always include escalation clauses in your bids!

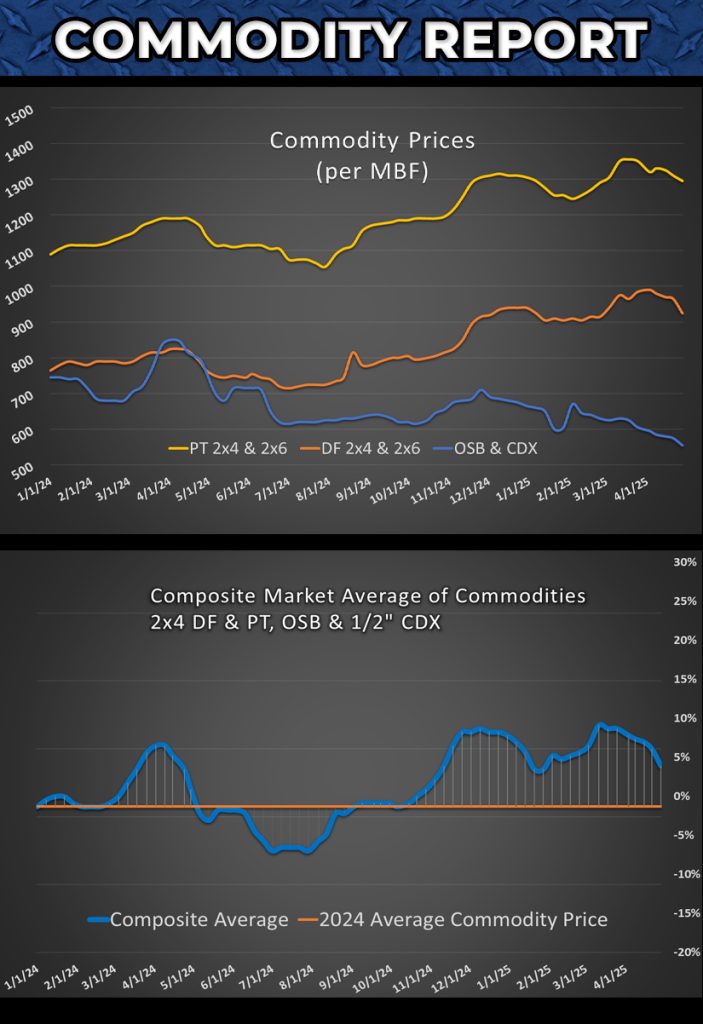

A number of prices have fallen this week, though it’s very difficult to point to definitive reasons for why. None the less, we will certainly take the decreases! Decreases were lead primarily by 2×4 Doug Fir and OSB of all thicknesses/sizes.

Our composite average dropped 2.6%, with our trailing 4 weeks down 4.6%.

Here’s a list of the main movers:

- Doug Fir 2×4 -4.3%

- Doug Fir 2×4 – 92-5/8″ -3.3%

- Doug Fir 2×4 – 104-5/8″ -3.0%

- Doug Fir 2×6 – 92-5/8″ -4.2%

- Doug Fir 2×6 – 104-5/8″ -3.8%

- Pres Treat 2×10 -3.2%

- 1-1/8″ SE Plywood -3.8%

- 1-1/8″ T&G Plywood -5.3%

- CDX 3/8″ -3.2%

- CDX 5/8″ -3.2%

- OSB 15/32″ -6.7%

- OSB 5/8″ -3.2%

- OSB 7/16″ -6.0%

- OSB 7/16″ 4×9 -8.6%

- OSB 7/16″ 4×10 -4.7%

Since looking at single SKU prices can be a little hard to see the forest from the trees we’ve started reviewing price changes on a sample home. The sample house we are using is a small 3 bedroom, 1,064 SF home with a 2 car garage. This week the cost of this home dropped $304.64.

In other areas, we are keeping an eye on product availability and pricing throughout our stores. We’ve had a keen eye on the lack of shipping containers in the Port of Seattle, but as of yet have not heard from our vendors about any supply shortages. We will certainly keep you posted!

As a reminder, the proposed increase in CVD’s (countervailing duties) on Canadian lumber is not expected to hit until the fall – though plenty may change between now and then.

It remains extraordinarily difficult to forecast where prices will be headed, so I will refrain from offering commentary on this topic.

Danny Steiger│President & CEO

Lumber Traders Inc.

Angeles Millwork & Lumber Co., Inc.

Angeles Rentals Equipment & Supply

Hartnagel Building Supply, Inc.

Hartnagel Glassworks

As always, the above content is not financial advice. Simply data to help you be better prepared. Our goal is to create more informed builders and homeowners to properly price and budget for future jobs and projects.

We will continue to update you on changes in the commodity market. Displayed above are the latest graphs.

Angeles Millwork and Hartnagel Building Supply see our customers as business partners, and their success is, in turn, ours. That is why every month, we will publish a commodity pricing chart on our Facebook page and in our monthly newsletter. The chart will represent a correlation of average pricing trends over the past year of Douglas Fir 2×4, Pressure Treated 2×4 Lumber, 7/16” OSB, and ½” CDX.

Stay ahead of lumber price changes with our Monthly Lumber Commodity Report. Get expert insights, graphs, and market trends to help plan your construction or remodeling projects with confidence.

Welcome to our Monthly Lumber Commodity Report.

This resource is dedicated to providing builders, contractors, and homeowners with the latest insights into lumber market fluctuations, aimed at empowering you to make informed decisions for pricing and budgeting future projects enabling better preparation and planning for your construction and home improvement endeavors.

To ensure you’re always updated, bookmark this page and consider subscribing for direct updates by emailing dannys@lumbertradersinc.com with “Please add to commodity report” in the subject line.

As a subscriber, you’ll receive these critical reports straight to your inbox, providing you with the knowledge needed to navigate the complexities of lumber pricing effectively. Stay informed with us, and together, let’s build a future that’s not just promising but well-prepared.

See below for latest graphs and commentary.

As you do your quotes, just a reminder to always include escalation clauses in your bids!

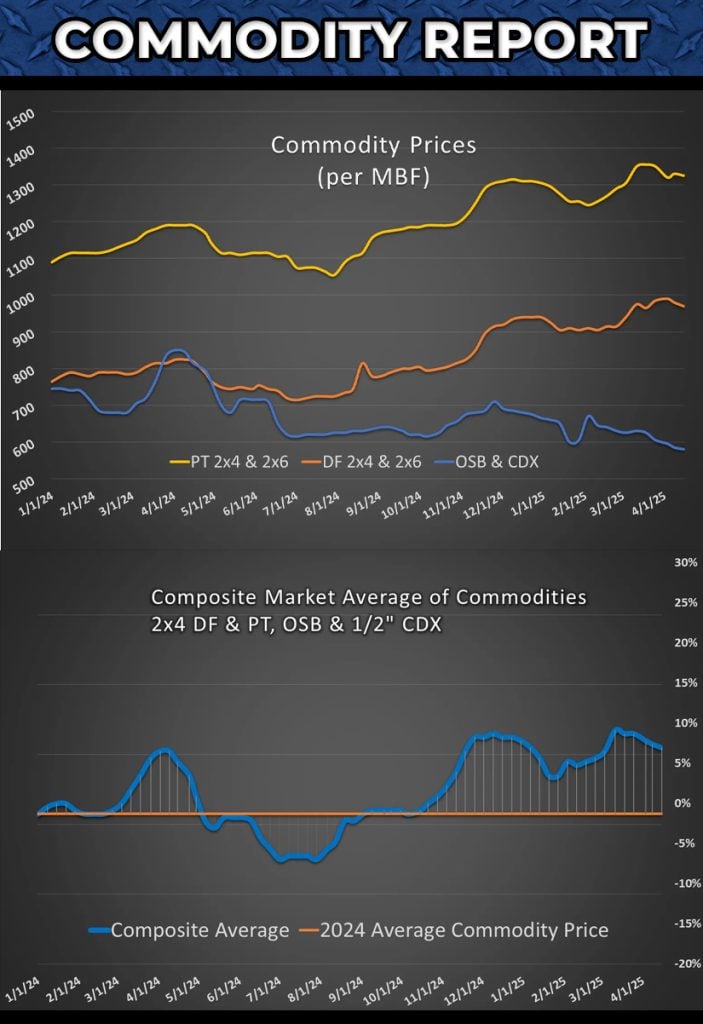

Here’s a break down of specific materials:

- Doug Fir 2×6 -5.5%

- Pres Treat 2×6 -5.4%

- Pres Treat 2×10 -5.4%

- Pres Treat 2×12 -5.3%

- OSB 15/32” -4.8%

- OSB ¾” EG -3.3%

- OSB 7/16” 4×8 -4.8%

- OSB 7/16” 4×10 -4.8%

- 1-1/8” T&G Ply +5.5%

- ThermaTru doors 4.5% – 6.5% increase

- RailFX railing 21% increase

- Metabo pneumatic tools 5% increase

- CRL shower hardware 5% increase

- Tyvek house wrap 4% increase

- PrimeSource (vast array of products) 5% – 45% increases

Danny Steiger│President & CEO

Lumber Traders Inc.

Angeles Millwork & Lumber Co., Inc.

Angeles Rentals Equipment & Supply

Hartnagel Building Supply, Inc.

Hartnagel Glassworks

As always, the above content is not financial advice. Simply data to help you be better prepared. Our goal is to create more informed builders and homeowners to properly price and budget for future jobs and projects.

We will continue to update you on changes in the commodity market. Displayed above are the latest graphs.

Angeles Millwork and Hartnagel Building Supply see our customers as business partners, and their success is, in turn, ours. That is why every month, we will publish a commodity pricing chart on our Facebook page and in our monthly newsletter. The chart will represent a correlation of average pricing trends over the past year of Douglas Fir 2×4, Pressure Treated 2×4 Lumber, 7/16” OSB, and ½” CDX.

Stay ahead of lumber price changes with our Monthly Lumber Commodity Report. Get expert insights, graphs, and market trends to help plan your construction or remodeling projects with confidence.

Welcome to our Monthly Lumber Commodity Report.

This resource is dedicated to providing builders, contractors, and homeowners with the latest insights into lumber market fluctuations, aimed at empowering you to make informed decisions for pricing and budgeting future projects enabling better preparation and planning for your construction and home improvement endeavors.

To ensure you’re always updated, bookmark this page and consider subscribing for direct updates by emailing dannys@lumbertradersinc.com with “Please add to commodity report” in the subject line.

As a subscriber, you’ll receive these critical reports straight to your inbox, providing you with the knowledge needed to navigate the complexities of lumber pricing effectively. Stay informed with us, and together, let’s build a future that’s not just promising but well-prepared.

See below for latest graphs and commentary.

As you do your quotes, just a reminder to always include escalation clauses in your bids!

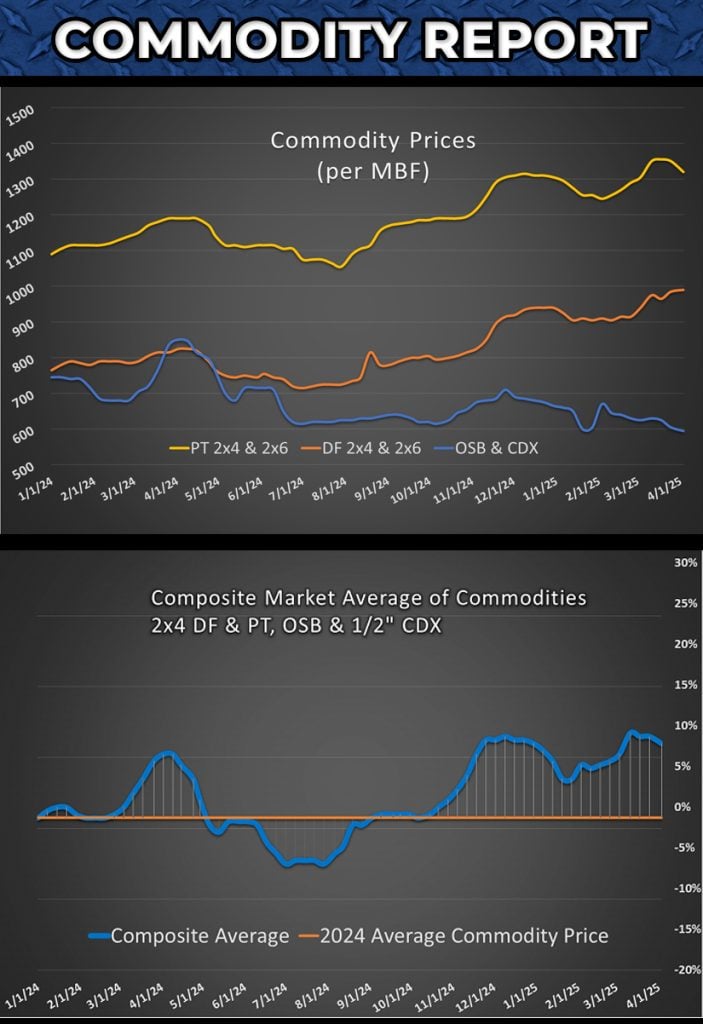

It’s been a busy day in the markets with much time spent trying to understand the implications of the newest round of tariffs. I’ll first share commodity pricing information, then dive into the other areas of building materials likely to be impacted (spoiler: most products)

Week over week our commodity composite average dropped 1%, however the trailing four weeks are up 1.6%. Here’s the break down by commodity product:

- Doug Fir 2×4 +8.2%

- DF 2×4 – 92-5/8” +0.8%

- DF 2×4 – 104-5/8” +1.5%

- DF 2×6 – 104-5/8” +1.4%

- Pres Treat 2×8 -3.0%

- Pres Treat 2×10 -3.3%

- Pres Treat 2×12 -3.3%

- Pres Treat 4×6 +2.1%

- CDX 3/8” -4.3%

- CDX 1/2″ -3.4%

- CDX 5/8” -4.8%

- OSB 15/32” -4.5%

- OSB 5/8” -3.9%

- OSB 7/16” 4×8 -4.5%

- OSB 7/16” 4×9 -0.8%

- OSB 7/16” 4×10 -8.7%

Our sample house increased about $450 each week for the last two weeks, largely impacted by DF 2×4 pricing, as well as general price increases on other building materials. Which is the perfect segue… I wanted to share some information we’ve compiled via our suppliers and other new sources in regards to prices affected by the newest tariffs.

As you may have heard, recent developments in international trade policy are likely to affect our industry significantly. The U.S. government has implemented new tariffs impacting a broad range of imported products, including many key building materials and hardware items.

Here’s What You Need to Know:

Tariffs Overview:

- Effective immediately, an additional 10% universal tariff applies to all imported goods.

- Specific “reciprocal” tariffs are also being imposed on goods from certain countries: 34% for products from China (on top of an existing 20%), 45% from Vietnam, and 26% from India, among others.

- Steel and aluminum imports have seen a separate 25% tariff imposed, affecting prices across various construction and hardware categories.

Market Conditions & Pricing: The National Association of Home Builders estimates these tariffs could add roughly $9,000 to the cost of constructing an average home. Although some building materials, notably lumber from Canada and drywall from Mexico, have been exempted from new tariffs, substantial price impacts on appliances, windows, doors, furniture, and imported metals are expected.

Furthermore, market uncertainty may also lead to fluctuations in mortgage rates and consumer confidence, potentially impacting broader economic conditions. The current level of tariffs has significantly increased economic uncertainty, raising the possibility of a recession if prolonged.

What This Means for You: Despite our efforts, some price increases will be inevitable. We anticipate price adjustments across many product categories in the coming months, aligning closely with market trends to maintain competitive pricing while protecting your margins. Keep in mind that not all of our products are imported, but most have at least components that are imported. This leads us to believe that most items in our stores will be impacted to varying degrees by these tariffs.

We’re committed to keeping you fully informed and supported through these developments. Expect clear and timely updates as the situation evolves. Thank you for your continued trust and partnership. Together, we’ll navigate these changes to ensure your projects continue smoothly and successfully.

Danny Steiger│President & CEO

Lumber Traders Inc.

Angeles Millwork & Lumber Co., Inc.

Angeles Rentals Equipment & Supply

Hartnagel Building Supply, Inc.

Hartnagel Glassworks

As always, the above content is not financial advice. Simply data to help you be better prepared. Our goal is to create more informed builders and homeowners to properly price and budget for future jobs and projects.

We will continue to update you on changes in the commodity market. Displayed above are the latest graphs.

Angeles Millwork and Hartnagel Building Supply see our customers as business partners, and their success is, in turn, ours. That is why every month, we will publish a commodity pricing chart on our Facebook page and in our monthly newsletter. The chart will represent a correlation of average pricing trends over the past year of Douglas Fir 2×4, Pressure Treated 2×4 Lumber, 7/16” OSB, and ½” CDX.

Stay ahead of lumber price changes with our Monthly Lumber Commodity Report. Get expert insights, graphs, and market trends to help plan your construction or remodeling projects with confidence.