Lumber Commodity Report

Welcome to our Monthly Lumber Commodity Report.

This resource is dedicated to providing builders, contractors, and homeowners with the latest insights into lumber market fluctuations, aimed at empowering you to make informed decisions for pricing and budgeting future projects enabling better preparation and planning for your construction and home improvement endeavors.

To ensure you’re always updated, bookmark this page and consider subscribing for direct updates by emailing dannys@lumbertradersinc.com with “Please add to commodity report” in the subject line.

As a subscriber, you’ll receive these critical reports straight to your inbox, providing you with the knowledge needed to navigate the complexities of lumber pricing effectively. Stay informed with us, and together, let’s build a future that’s not just promising but well-prepared.

See below for latest graphs and commentary.

As of 10/17/2024

- 2×10 DF – up 2%

- 2×12 DF – up 5%

- 2×12 PT – up 2%

As you do your quotes, just a reminder to always include escalation clauses in your bids!

Danny Steiger│President & CEO

Lumber Traders Inc.

Angeles Millwork & Lumber Co., Inc.

Angeles Rentals Equipment & Supply

Hartnagel Building Supply, Inc.

Hartnagel Glassworks

As always, the above content is not financial advice. Simply data to help you be better prepared. Our goal is to create more informed builders and homeowners to properly price and budget for future jobs and projects.

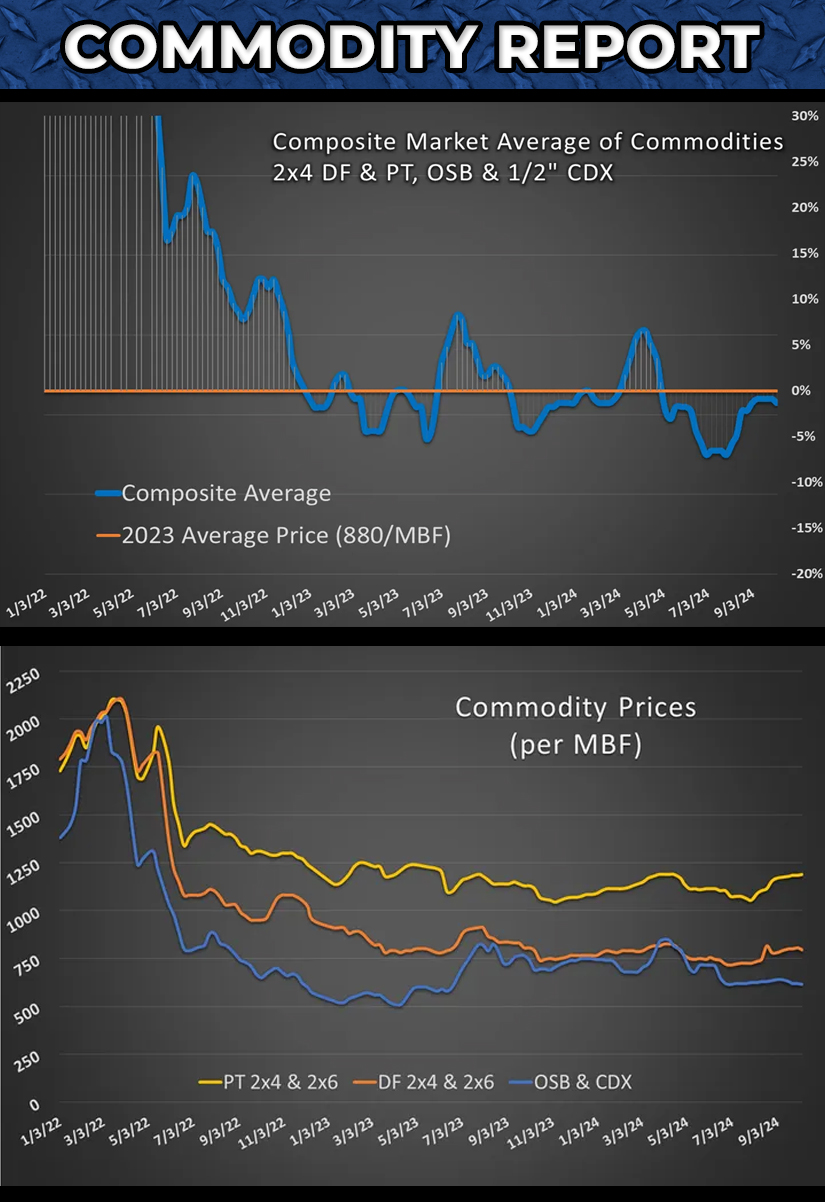

We will continue to update you on changes in the commodity market. Displayed above are the latest graphs.

Angeles Millwork and Hartnagel Building Supply see our customers as business partners, and their success is, in turn, ours. That is why every month, we will publish a commodity pricing chart on our Facebook page and in our monthly newsletter. The chart will represent a correlation of average pricing trends over the past year of Douglas Fir 2×4, Pressure Treated 2×4 Lumber, 7/16” OSB, and ½” CDX.